do nonprofits pay taxes on rental income

This method requires you to report income as you receive it and expenses as you pay them out. However this corporate status does not.

Rental income from real property received by exempt organizations is normally excluded from unrelated business taxable income UBTI.

. An agricultural organization a board. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. Do nonprofit organizations have to pay taxes.

But determining what are an. Just because you have a tax-exempt status it does not mean that youre well tax. Report rental income on your return for the year you.

Taxable if Income from any item given in exchange for a donation that costs the. Tax Exempt if All unrelated items eg snacks and drinks Minimum Suggested Donation items. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types of taxes under certain.

Its worth noting though that not everyones personal allowance will be the same as it can. While most US. Get a personalized recommendation tailored to your state and industry.

But nonprofits still have to pay. Nonprofits are not required to pay personal property taxes though some do choose to do so. This guide is for you if you represent an organization that is.

When the IRS reclassifies rentals as not-for-profits the rental income and expenses must be reported differently than ordinary rentals resulting in a severe loss of tax. Your recognition as a 501 c 3 organization exempts you from federal income tax. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

The main reason for this is that nonprofits are exempt from paying federal. A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act. If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax.

Did you know that sometimes nonprofits must pay income tax. But some businesses use the accrual method of accounting. Yes nonprofits must pay federal and state payroll taxes.

June 30 2021. Most nonprofits do not have to pay federal or state income taxes. Ad Find out what nonprofit tax credits you qualify for and other tax savings opportunities.

However rent may not fall under the. However here are some factors to consider when.

8 Tips To Create Income From Rental Property Rental Property Commercial Property For Rent Property For Rent

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

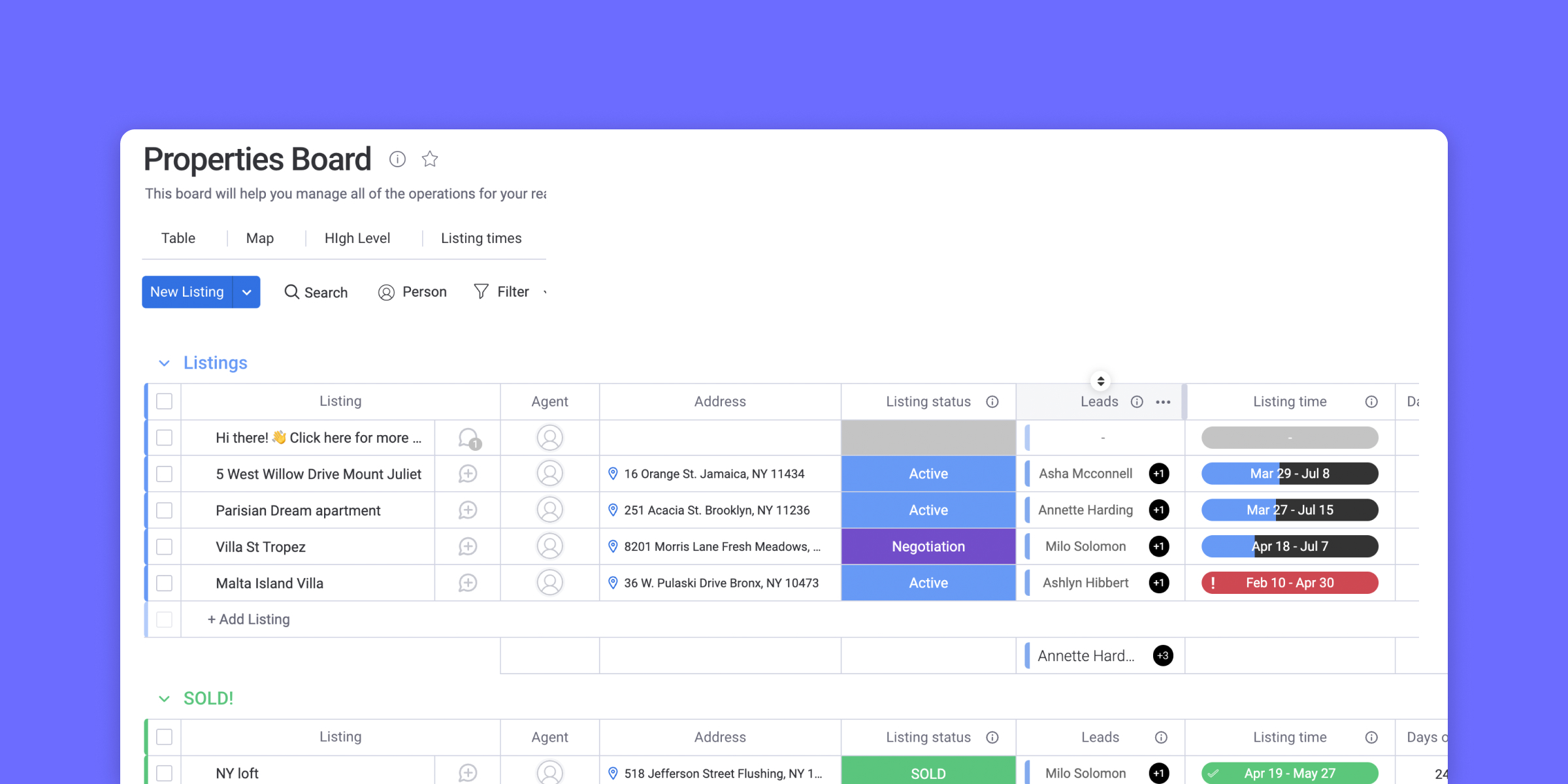

Best Rental Property Spreadsheet Template For Download Monday Com Blog

Nonprofit Accounting How Not For Profit Organizations Can Prepare For An Non Profit Nonprofit Fundraising Profit

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

Best Rental Property Spreadsheet Template For Download Monday Com Blog

/renting-vs-owning-home-pros-and-cons.asp-ADD-V2-2ce9de919eb94f62bd4e4c7a23010852.jpg)

Renting Vs Buying A Home What S The Difference

Free Cash Flow Forecast Templates Smartsheet Cash Flow Free Cash Smartsheet

The Nonprofit Sector In Brief Visual Ly

How To Make Your Nonprofit Facebook Page Great In Under Five Hours Non Profit Fetal Alcohol New Facebook Page

/renting-vs-owning-home-pros-and-cons.asp-ADD-V2-2ce9de919eb94f62bd4e4c7a23010852.jpg)

Renting Vs Buying A Home What S The Difference

Best Rental Property Spreadsheet Template For Download Monday Com Blog

Sample Nonprofit Business Plans Bridgespan For Non Profit Business Plan Template Free Do In 2022 Business Plan Template Business Plan Template Free Business Planning

Accounting Spreadsheets And Document Examples Nonprofit Accounting For Volunteers Treasurers And Bookkeepers In 2022 Bookkeeping Accounting Non Profit

Keys Receipts Being A Landlord Tenants Rental Property Management

Beginner S Guide To Rental Income For Non Profits Taxable Or Not Blue Co Llc